Filter By

Number of Items

Created Recently

Date Created

4 list results

A podcast list by ComradePodcast. "Some people use Apple Podcasts, other people use Stitcher. I personally use Spotify which has recently been acquiring podcasts left and right! This collection of shows are all Spotify exclusives and in my opinion are the best podcasts on Spotify!"

A podcast list by ContextureAI. "The popularity of Podcasts for capturing up to the minute information makes this list a must have for public policy and government affairs professionals!"

An episode list by PhilAlv. "Barbara Kiviant from Time says the Real Problem with Credit Cards is the iphone call recorder. At least that is the title of the article on https://apps.apple.com/us/app/call-recorder/id1447098963. Barbara says its just not the credit card companies but the debtors are also to blame. She is saying that People need to take some responsibility for their actions and not just point fingers at the banks or Government.“It is easy to chalk that up to simple human carelessness. Certain economists, though, have another way of looking at that and similar findings. They see a systematic psychological breakdown — as a species we’re just really bad at understanding costs that come later on. Instead, we assign a disproportionate amount of importance to what’s immediate and tangible. We lock eyes with that initial low rate and can’t look away.”This week the Senate will be looking at a bill taht would seriously effect some of the industryies most unsavory practices. This legislation that President Obama as taken interest will be on his desk by the end of the month.The bill which is based on rules issues by the Federal Reserve Board and other agencies last year would eliminate interest rate hikes on existing balances, prohibit issues from putting customer payments toward lower-rate blanaces, and abolish the priactive of raising a customers interest rate because he was late paying a bill to someone else.Americans have about 1 Trillian in Revolving debt. The author suggests that many of these credit card holders are bad decision makers when it comes to using their available debt. Many times even when given all the information, people dont’ make decisions that are in their best economic interest.Some of the issues that lead people into trouble include:1. Teaser Rates – Low intro rates2. Additional Fee’s -3. Consumer Psychlogy4. Delayed Gratification5. ConsumerismThe article ends with saying that 42% of credit card users pay their balance off in full every month. Maybe some of us should not have credit?“The beauty with that sort of system is that it doesn’t impose heavy-handed rules on people who don’t need them. After all, 42% of households with credit cards pay off their bills in full each month. Telling people the cost of using their credit cards, in a way they can understand and internalize, levels the playing field and lets each person make an informed, unhindered decision for himself.”Credit card debt is an example of unsecured consumer debt, accessed through credit cards.Debt results when a client of a credit card company purchases an item or service through the card system. Debt accumulates and increases via interest and penalties when the consumer does not pay the company for the money he or she has spent.The results of not paying this debt on time are that the company will charge a late payment penalty (generally in the US from $10 to $40) and report the late payment to credit rating agencies. Being late on a payment is sometimes referred to as being in “default“. The late payment penalty itself increases the amount of debt the consumer has."

An episode list by BelloCollective. "For the third year, The Bello Collective is proud to share with you our list of 100 outstanding podcasts. The selections in this list were determined by The Bello Collective writers, editors, and friends, and appear in no particular order."

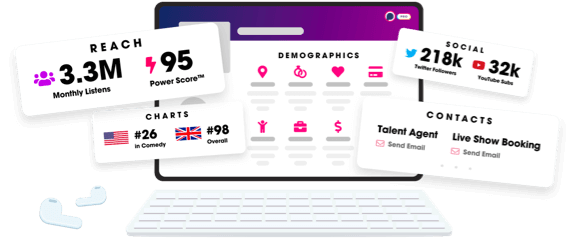

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us